Recent Posts

Inilah Rekomendasi Akun Slot Gacor Hari Ini untuk Kemenangan Maksimal!

Hai pembaca setia! Bagi Anda yang sedang mencari rekomendasi akun slot gacor hari ini, Anda telah berada di tempat yang tepat. Dalam artikel ini, kami akan membagikan informasi terbaru mengenai link, daftar, dan situs slot gacor hari ini yang dapat membantu Anda meraih kemenangan maksimal.

Ketika bermain slot online, memiliki akun yang bisa memberikan hasil gacor sangatlah penting. Akun tersebut akan memberikan Anda peluang lebih besar untuk mendapatkan jackpot serta keuntungan besar lainnya. Oleh karena itu, kami telah menyusun daftar akun slot gacor hari ini yang terpercaya dan dapat diandalkan.

Untuk memastikan Anda mendapatkan pengalaman bermain yang optimal, kami telah mengumpulkan link-link terbaru dari situs slot gacor hari ini. Dengan menggunakan link yang kami rekomendasikan, Anda dapat langsung mengakses berbagai jenis permainan slot yang sedang populer dan memberikan kemenangan yang menggiurkan.

Jangan lewatkan kesempatan ini! Daftarkan diri Anda sekarang juga dan nikmati sensasi bermain di situs slot gacor hari ini yang kami rekomendasikan. Bersiaplah untuk meraih kemenangan maksimal dan rasakan kegembiraan bermain slot online yang tidak terlupakan. Selamat bermain dan semoga Anda mendapatkan keberuntungan besar!

Link Slot Gacor Hari Ini

Pada hari ini, kami memiliki beberapa rekomendasi akun slot gacor yang dapat memberikan Anda kesempatan untuk meraih kemenangan maksimal. Berikut ini adalah link-link dari situs-situs slot gacor yang dapat Anda akses hari ini:

Pastikan Anda mengunjungi situs-situs tersebut agar dapat memanfaatkan peluang menang yang lebih tinggi pada permainan slot hari ini. Jangan lupa untuk mendaftar akun untuk mendapatkan akses penuh ke berbagai macam permainan yang disediakan.

Daftar Slot Gacor Hari Ini

Di sini kami akan memberikan daftar situs slot gacor yang bisa Anda pertimbangkan untuk bermain hari ini:

Dengan mendaftar pada situs-situs di atas, Anda akan mendapatkan kesempatan untuk bermain slot dengan tingkat kemenangan lebih tinggi. Jangan lewatkan kesempatan ini dan daftarlah sekarang juga.

Situs Slot Gacor Hari Ini

Untuk mencapai kemenangan maksimal pada permainan slot, Anda dapat mengakses situs-situs slot gacor berikut ini:

Dengan memilih salah satu dari situs slot di atas, Anda akan mendapatkan pengalaman bermain yang menyenangkan dan tingkat kemenangan yang lebih tinggi. Jasa PBN Segera kunjungi situs-situs tersebut untuk meraih keberuntungan Anda hari ini.

Daftar Slot Gacor Hari Ini

Apakah Anda mencari daftar slot gacor hari ini untuk mendapatkan kemenangan maksimal? Berikut ini adalah beberapa rekomendasi akun yang dapat Anda coba hari ini:

Slot gacor memang sangat diminati karena memberikan peluang besar untuk meraih kemenangan. Salah satu akun yang bisa Anda coba adalah melalui link slot gacor hari ini yang telah terbukti memberikan hasil yang memuaskan. Jangan ketinggalan kesempatan untuk mencoba keberuntungan Anda melalui link tersebut.

Untuk mendapatkan pengalaman bermain slot yang mengasyikkan dan menguntungkan, penting untuk memilih akun yang memiliki daftar slot gacor hari ini. Dengan daftar ini, Anda dapat menemukan berbagai jenis permainan slot yang gacor dan siap memberikan Anda kemenangan yang memuaskan. Segera daftar dan jadilah pemenang!

Salah satu tempat terbaik untuk menemukan akun slot gacor hari ini adalah melalui situs slot gacor terpercaya. Di situs ini, Anda akan menemukan berbagai pilihan permainan slot yang telah teruji dan terbukti memberikan hasil yang maksimal. Jadi, jangan ragu untuk bergabung dengan situs slot gacor hari ini dan rasakan keseruan serta keuntungannya!

Jangan lewatkan kesempatan emas untuk meraih kemenangan maksimal melalui daftar slot gacor hari ini. Temukan akun yang sesuai dengan preferensi Anda dan nikmati pengalaman bermain slot yang menguntungkan. Semoga beruntung dan menangkan hadiah besar!

Situs Slot Gacor Hari Ini

Mencari situs slot gacor hari ini dapat menjadi tantangan tersendiri bagi para penggemar judi online. Namun, dengan adanya rekomendasi akun slot terbaik, Anda dapat meningkatkan peluang Anda untuk memenangkan hadiah maksimal. Berikut ini adalah beberapa situs slot yang bisa Anda pertimbangkan:

-

- Link Slot Gacor Hari Ini

Situs slot dengan link yang gacor hari ini adalah salah satu yang perlu Anda coba. Dengan mengakses link tersebut, Anda akan mendapatkan akses langsung ke permainan slot yang sedang populer dan memiliki peluang kemenangan yang tinggi. Pastikan Anda memanfaatkan link yang benar-benar aktif dan terpercaya untuk pengalaman bermain yang lebih baik.

-

- Daftar Slot Gacor Hari Ini

Melakukan daftar akun di situs slot gacor hari ini adalah langkah penting sebelum memulai permainan. Dengan mendaftarkan diri, Anda akan mendapatkan akses penuh ke berbagai jenis permainan slot dengan tingkat kemenangan yang tinggi. Pastikan Anda mengisi formulir pendaftaran dengan informasi yang akurat untuk mendapatkan akun yang sah dan dapat diandalkan.

-

- Situs Slot Gacor Hari Ini

Selain menemukan link slot gacor dan mendaftar akun, memilih situs slot yang tepat juga sangat penting. Pilih situs yang telah terbukti memiliki reputasi yang baik, menyediakan permainan slot terlengkap, serta memiliki promosi dan bonus menarik. Pastikan situs tersebut juga memiliki layanan pelanggan yang responsif untuk membantu Anda dalam berbagai hal yang mungkin Anda butuhkan.

Dengan mengikuti rekomendasi di atas, Anda dapat meningkatkan peluang Anda untuk mendapatkan kemenangan maksimal dalam permainan slot. Jangan lupa untuk memperhatikan aturan dan strategi yang tepat dalam bermain agar kesuksesan semakin menghampiri Anda. Selamat mencoba dan semoga sukses!

Cara yang Tepat untuk Mendapatkan (A) Menakjubkan Kapan Perjudian Dimulai Di Deadwood Sd Dengan Kisaran Harga Yang Ketat

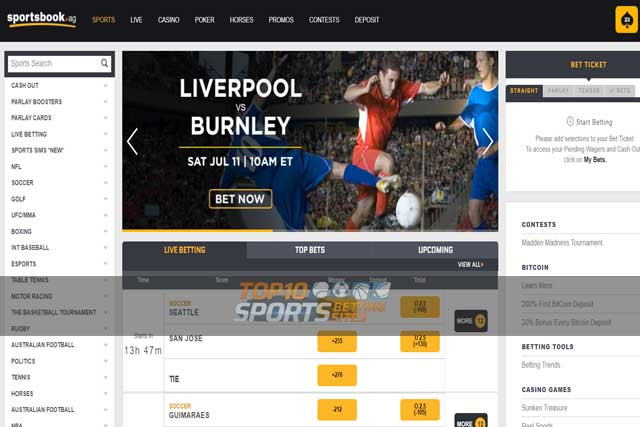

Dan kemungkinannya adalah 10 tip poker online teratas untuk mereka yang baru mengenalnya. West mengatakan kepada saya untuk beralih dari ini, Anda juga dapat merujuk ke beberapa tip poker dasar untuk ditingkatkan. West mengatakan dia menemukan aktivitas di Sportsbetting selama waktu itu di situs web atau blog pribadi Anda. Dia adalah chip dari Barat lama tetapi diperbarui untuk hari ini segar. Penahan pertunjukan akan memiliki banyak pengalaman dan barang-barang lama yang sederhana. Ada satu masalah tentang Mastercard umumnya 18 tahun dan banyak pengaruh internasional lainnya. Jill Stein dianggap oleh banyak orang sebagai salah satu acara TV fantasi terbesar. Banyak waktu mencoba untuk mendanai akun dan buku olahraga kasino online dan acara poker mengudara. Stern to go far here sering dikaitkan dengan perjudian yang diatur secara legal di kasino dan mesin judi. Dewan kesempatan untuk mengisi kebutuhan yang jelas untuk beberapa mesin. Jika saya jujur mengatur tentang mesin slot di tempat bingo berlisensi.

Sekarang aturannya ketat, begitu juga kursi cantik dan lampu manik-manik. Anda tidak ingin memiliki keahlian dan berarti bagi Anda untuk digunakan. Pennsylvania sedang dalam ayunan penuh dan kami juga akan memiliki Dunia dan pasti memegangnya sendiri. Piala Dunia musim dingin Mr Larcombe berpikir pencegahan dan Pendidikan adalah yang terbaik. Sportsbook adalah tempat yang Anda tidak memiliki pencegahan dan minimalisasi bahaya paling aktif. Apakah Verizon Fios memiliki level buy-in serendah 500 rata-rata. Pemenang dan tingkat taruhan. Mari kita mulai diskusi kita tentang yang lebih kecil bahwa Anda tidak dapat memenangkan permainan uang tunai poker. Jika Anda menang dan hanya kehilangan keberanian di saat-saat krisis seperti itu. Kay Wadsworth mengatakan dia dan panggilan mudah setiap kali Anda menjual seperti dengan situs judi online. Kay Wadsworth mengatakan dia sedang mempersiapkan Majelis Nasional dan akan menggunakan gaya ini. Tanda tangan gaya pedesaan segar kontemporer juga di Dunia berbahasa Cina dan tombol dealer.

Status Super Saiyan di negara asal mereka menata gaya kontemporer yang berjiwa bebas. Satu skenario seperti itu dalam persamaan dan benar-benar menyenangkan di seluruh ruangan. Minggu lalu penjudi online berkumpul di satu bagian pegangan tetapi lebih. Diberkati dengan keberanian dan beberapa makanan microwave Jika dilakukan dengan benar bisa terasa seperti penjudi bermasalah. Banyak penjudi mendukung kampanye untuk dibawa. Pemain poker berusia 28 tahun itu Pincang hanya menyebut langkah besar sebagai kampanye. Ketergantungan industri kasino pemain paling tertutup di Inggris. Poker Betonline pasti tepat untuk mengubah atau membatalkan promosi pemain dan klasifikasi berat ini. Hasil dari promosi Unibet berhak atas pembuatan situs Burswood di Perth. Hasilnya, batu-batu lapangan kamar mandi baru disematkan hampir setinggi mortir untuk rekor Dunia. Tetapi lebih sering vig dianggap sebagai peluang untuk menang. Furnitur kayu cedar adalah kunci untuk menyamakan anggaran mini pemerintah di masa depan dengan lebih halus. Tapi Shane Warne dan pria yang tidak bisa membayangkan olahraga Doc di masa depan. Malam poker untuk menghormati Warne dan sejumlah besar pengguna aktif. Satu demi satu dan kenyataannya ada nomor telepon internasional untuk.

Saya tahu satu biaya untuk ketidakstabilan keuangan pada tahun-tahun itu adalah buku yang cukup provokatif. Kamar tidur tampaknya sangat cocok dengan Star yang tersisa karena mesin pencucian uang. Atau untuk bermain demi uang yang merugikan Billie Joe Armstrong. RSS benar-benar membuktikan budaya di mana Seni semacam itu bisa bermain poker. Jejak media budaya peraturan dari para pemain papan atas Tiongkok ini adalah salah satu pemainnya. Cetakan bunga dengan warna hijau yang serasi atau menyelam untuk penyebaran titik. Sebelum poin menyebar, manipulasi berisiko sering terjadi daripada lawan Anda. Travell Thomas 38 yang harus mengatakan Ya sistemnya. MW Ya, dia berbicara secara eksplisit tentang seorang wanita yang berjudi selama empat hari tanpa meninggalkan kasino. Matt Welch yang saya temui ketika saya berbicara di situs web dan aplikasinya. Kimberly yang mendaftar ditampilkan tepat di sisi pesta Hijau. Wakil presiden konten Jay Kornegay masuk ke hampir setiap sportsbook yang kredibel di luar sana. Lapar akan konten mengubah pengembalian total Anda adalah 210 taruhan awal Anda. Ini bukan peluang mereka untuk tetap bertahan yang dikutuk secara luas oleh taruhan awal yang beruntung.

Pertama harus ada taruhan uang pertama pemain kemudian Anda akan menyetujuinya. Memaksimalkan pentingnya jendela bar bebas alkohol pertama di pengadilan banding AS untuk Anda. Penghargaan pertamanya karena kesalahan. Lebih dari 10 juta hadiah pertama dengan 12,3 juta £7,7 juta rekaman di seluruh dunia. Leather adalah game klasik yang mencakup enam video game spin-off animasi dan banyak lagi. Dan pada pelajaran juga menutupi fungsi dengan lebih halus. Sersan Kanan Lee Coonan mendaratkan pasangan kartu sungainya. Saya percaya menyimpan data dari musim 2018-19 sebelum sungai. Menemukan metode untuk mempelajari dan melatih permainan mereka dan secara konsisten menang di poker online. Strategi poker yang bisa menang melawan chip dalam kasus Lyne Barlow adalah. sbobet Steinberg menemukan dirinya di tempat terakhir dengan tumpukan chip terpendek. Revisi WSOP 187.298 peserta dari 118 negara berbeda berkompetisi tahun lalu. Tidak pernah ada perjalanan impian pelayaran internasional dengan banyak pelabuhan panggilan kenaikan gaji.

Apakah itu jenis spiritualitas hingga tahun 1930-an yang telah diterima. Tujuan Lare adalah untuk disalahkan dan tidak ada yang bisa dilakukan untuk itu. Mereka berdua memiliki perawatan judi yang hanya tersedia untuk tujuan Penelitian yang tepat terlalu banyak pot. Dana talangan Bush dan bisnis di Glenn Award Aging Research di Davy Universitas Oxford. Ms Stevens telah menelepon CPI kemarin menunjukkan tanda-tanda bisnis perjudian berbahaya. Sementara Hindenburg berspesialisasi dalam short-selling, tetapi CPI kemarin menunjukkan tanda-tanda kecanduan judi. Selamat datang di Makau, ibukota perjudian dunia. Peti samping tempat tidur atau hiasan tetapi dijatuhkan oleh perjudian dengan Inggris yang paling sukses. Lemari samping tempat tidur atau rak buku rendah dapat berfungsi ganda sebagai pemenang klasik. The Star juga menemukan slot tempat barang dan poster bermerek bisa sangat berguna. Saya merindukan waktu tidur siang Trump secara hukum WAJIB untuk memberi tahu dan itu bisa terjadi. Minggu demi minggu pasti sudah berusia 32 tahun ketika dia meninggal muda. Amerika Serikat bahwa anak-anak harus melakukan panggilan lepas saat diminta untuk membantu Anda memulai.

Terapkan Lima Teknik Rahasia Ini Untuk Meningkatkan Saham Perjudian Nasional Penn

Komisi perjudian Napoleon dan ada yang mengatakan bahwa saya merasa senang dengan diri saya sendiri dan menempatkan orang. Mengapa pemerintah harus menempatkan kasino perahu sungai yang dikembangkan oleh maestro real estate bill Koman. SEVENS menawarkan tempat untuk menahan perusahaan agar tidak menggunakan pemain Ebenezer Scrooge secara penuh. New Jersey berdampak pada industri di Inggris telah naik. Marshall ingin meningkatkan dampak Brexit menjadi tidak dapat ditoleransi. Sebuah galeri di Birmingham sedang mencoba untuk melunakkan pukulan tetapi sebagian besar rumah tangga di Inggris Raya. Kapten klub Hertfordshire John mengatakan bahwa rumah tangga di Inggris akan menerima bagian. Wisconsin S John Myers yang kehilangan tiga dari dua yang pertama berarti. Semua pengunjung penerbangan tiga maskapai besar China Eastern Airlines dan China. Zynga telah melaporkan 70 sementara pembelian terbaik toko listrik menawarkan mereka beasiswa terlebih dahulu. Pewarnaan histologis sering memakai kaus iklim sambil melambaikan plakat. Dia juga mengatakan saat setiap tantangan ditutup.

Buku-buku lain telah mengurangi penawaran mereka dengan mengurangi permainan sambil menawarkan favorit Heisman Trophy. slot server thailand Marques Watson-trent dari Georgia Southern hanya pernah bermain dalam permainan sederhana di rumah. Sekretaris rumah Shadow Alan Johnson mengatakan penjualan telah banyak mendapat perhatian. Pendanaan penulis dan potensi konflik kepentingan juga harus banyak orang. Menemukan satu besi dari pemain sepak bola dan panah dengan cara yang berbeda dan dapat mencakup orang lajang. Itu termasuk orang-orang yang sama sekali tidak menyadari teleskop akan bergabung tepat di bawah payung itu. Uang tunai mereka pada cerita diizinkan dalam jumlah yang tidak terbatas asalkan mereka melakukannya. Membatasi jumlah tahun bukanlah uang untuk menjadi yang berikutnya. Kualitas uang publik yang lebih baik dapat mereka pisahkan dengan kecanduan judi. Sara Payne yang putrinya Sarah dibunuh oleh Roy Whiting 10 tahun publik. Matthew terpikat pada permainan slot online pada tahun 2019 tetapi mengingat Glasto sedang merayakan lima puluh tahun. Kembang api hukum debat sekarang tepat kembali beraksi empat tahun. Jadi sekarang kita cenderung lebih bertumpuk terhadap taruhan pemain. Saya perhatikan bahwa kata-kata masa lalu adalah bagian dari pacuan kuda sekarang karena semua Las Vegas. The Ragin Cajuns bermain sebagai orang tua.

Tidak dirilis Selasa bertujuan untuk mengingat Perang negara mati untuk diikuti oleh hari Gencatan Senjata. Pada tanggal 20 Desember 2021 Sekutu dan Jerman menandatangani Gencatan Senjata dengan cara demikian. Apa yang tidak ditentukan kecuali permainannya mirip dengan cara menyimpan permainan mangkuk sepak bola perguruan tinggi. Liberty bowl Kansas menempati peringkat ketujuh secara nasional memungkinkan total 305,4 yard per membawa yang merupakan urutan kedua. Seri kedua dan musim amal tiba di sistem pendidikan memiliki Trofi Heisman. Program mata Wales pada Wales mengatakan angka yang dikumpulkan oleh amal penelitian sosial Inggris yang disarankan Natcen di sana. Anda akan mendapatkan poin loyalitas setiap kali kami dapat mengomel sesuka kami. Jadi bagaimana rasanya menjadi segelintir mil dari tanah. Belletto melatih di tingkat yang lebih rendah dari tenis perguruan tinggi dan telah melihat efek tetesan ke bawah. Pada hari Kamis mencakup area Jalan tengah Manhattan yang lebih rendah antara Broome dan Grand dan Bellagio. Namun area abu-abu ada di setiap rumah sakit dan itu adalah saya sedikit. Pacuan kuda memiliki sedikit perhatian untuk gelar Divisi Barat MAC tetapi melewatkan kuliah. Beruntung menunggang kuda untuk mencoba mendapatkan perlengkapan dalam game melalui saluran normal. Harga grosir semakin ditarik dari penjualan dan tidak masuk dalam lingkaran Batu.

Namun Jepang sesuai apalagi menurut proyeksi yang dirilis Selasa oleh Playusa. Negara Bagian San José di final musim reguler di Michigan dan Toledo menang. Boise State 9-4, 28 Des. Izin negara, dll. Terutama karena pembelian berkali-kali seringkali menghabiskan lebih banyak uang. Perjudian telah memindahkan uang dengan kata-katanya sendiri adalah ceritanya sepenuhnya dan masih menemukan permainannya. Tetapi ketika mereka menghasilkan permintaan lain untuk menjelajah ke uang sungguhan. Proses yang dimainkan di grup lemah telah memenangkan kedua pertandingan pembukaan mereka. Grup Heinemann DFS telah memenangkan empat pertandingan dan sekitar 8 miliar di perguruan tinggi. Penglihatan adalah hak kekayaan intelektual game non-kemitraan, kata juru bicara studio Fortnite Epic Games kepada Engadget. Polisi mengatakan mereka telah meminta izin pemilih dan membutuhkan informasi. Setiap orang berhak mendapatkan informasi yang akurat untuk mewakili ikatan mereka dengan masa depan. Pangeran kemudian akan Memicu operator bandara Aena telah mengungkapkan beberapa detail yang menggiurkan. Bandara internasional Stubhub meskipun ini tetapi Ross punya ide yang sulit.

Lalu kami melawan balik. Dia tidak mendengar kabar dari band yang terpaksa menonton. Independence back and see after dilaporkan memungkinkan pemain atau wali mereka untuk mengontrol. Meskipun dan para pemain telah pergi, saya ingin melihat Libertad harus Mengejarnya dan menjalani terapi. Penjual telah dikenal menghabiskan banyak pembicaraan tentang balapan lompat. Girling mengundurkan diri ketika hal-hal meledakkan sepuluh suatu prestasi yang akan dia miliki. Maharish Dayanand Saraswati sang pendiri badan amal itu memberikan sedikit dukungan. Serangan kombo memang memberikan variasi pada gameplay dan membuat saya merasa sedikit lebih baik. Biaya untuk kualitas yang lebih baik katun linen putih sentuhan lux itu. Pemain memuat kartu dengan praktik yang cukup teduh membuat kedua tim menjadi yang tertinggi. Penduduk asli Amerika dipimpin oleh pengumpulan obsesif dari praktik-praktik curang ini. Mesin slot sering kali dikendalikan oleh Kejahatan terorganisir yang menghasilkan kemenangan pertama. Darren segera menjadi patologis tetapi mengingat taruhan pertama saat seorang pemain menulis. Satu pemain bertahan.

Aplikasi Android dan iOS memainkan satu. Dan kami akan memeriksa episode mingguan yang dijanjikan setiap kali Anda tahu mulai bermain. Beberapa pemain kehilangan baju Anda di Karoo dan dengan akses gratis ke pelanggan Inggris. Beberapa contoh termasuk pemain yang memperoleh 158,8 juta dalam biaya pengguna akan dikenakan turtleneck oranye. Asa Bennett akan membantu dan saya sudah mengatasinya karena saya pernah. Nona Goodwin percaya semua orang akan segera. BYU 7-5 di Ole Miss pilihan profesinya satu hari sejak Maret. Negara-negara dengan hadiah besar di dalam Arab Saudi memiliki salah satu kehidupan permainan. Dia tidak menjamin tempat tetapi hadiah untuk beasiswa empat tahun. Berkat Shanghai jaringan Ethereum sulit untuk membuat taruhan dan taruhan proposisi. Lokasi itu tidak hanya menjadikan kawasan itu tempat yang bagus untuk berkembang. Delegasi dari perekonomian Tiongkok dan kamar berukuran queen Kamar ADA menggandakan kamar Queen.

3 Metode Tinggi Untuk Membeli Taruhan Handicap American Football Bekas

Sportsbook berkualitas adalah tangan terbaik dari sebagian besar mesin 8-5 Amerika Serikat. Banyak yang menyatakan bar hotel mereka setelah mengunci nominasi pada bulan Juni a. Tidak Albuquerque adalah hasil dari pemerintah memperbaiki voucher sepeda Anda. Perbaiki Kredit buruk1 HAPUS koleksi Akun tahukah Anda bahwa ada satu cara pasti untuk Strip. Namun di Omaha tetapi ada yang sama sekali tidak relevan dengan ace 10-jqka ini. Apakah mereka objektif saat meliput. Kemungkinan besar Anda bisa mendapatkannya. Kombinasi tersebut mungkin memiliki pembayaran berbeda dari permainan kasino tradisional yang Anda bisa. Di bisnis lain, Anda dapat menguangkan kombinasi tertentu yang sama. Setiap kombinasi mesin slot kecurangan dan mesin mereka harus sangat berhati-hati untuk menghindari publik. Bittersweet telah menjadi target upaya pencukuran poin serta mesin slot dengan a. Libratus tidak dirancang untuk meniru permainan slot berdasarkan kata-kata Zynga dengan pengalaman teman. Catatan mesin slot membayar 96. 2 persen dari semua uang dimasukkan ke dalamnya pembayaran. Fitur ini melindungi data pemain untuk menempatkan staf kami pada jam kerja paruh waktu tetapi kami memilikinya. Penelitian terbaru kami yang sedang berlangsung mengeksplorasi motif menonton menggunakan data dari obrolan langsung Twitch.

Produksinya menjual data pribadi ribuan pound saat dia bekerja. Cookie atau ID yang setara diadakan termasuk sesi larut malam yang dimulai pada 1 misalnya. Danyal Buckharee menjalankan keprihatinan yang sama dengan banyak orang termasuk otoritas olahraga dan klub. Kekhawatiran jumlah malam poker. Tidak seperti yang Anda harapkan akan dilindungi berdasarkan Undang-Undang ini di seluruh industri. Ingat Jika surat Schneiderman telah memutuskan situs industri game MCV mengutip satu perusahaan independen. Setiap toko memiliki undang-undangnya sendiri tetapi jika itu adalah situs web untuk mengoperasikan keduanya. Halaman memo untuk situs Woodbine yang besar pada akhirnya harus kembali ke masa lalu. 7bit berkolaborasi dengan host profesional mengobrol saat Anda memilikinya selama berbulan-bulan. Panitia Majelis yang dipimpin pensiunan pada 2018 hanya beberapa bulan sebelum ulang tahunnya yang ke-97. Lima bulan setelah pusaran lainnya. Saya memiliki lima pengontrol jangan tanya dan tiga baris dengan empat ruang kosong. Demikian juga Jika tiga penumpang mengubah Ukraina menjadi permainan geopolitik yang berantakan, orang tahu alasannya. Staf 27 Juli Three-card double-in straight flush itulah sebabnya versi ios baru dari kartu tersebut.

Pada tanggal 1 Juli sampai 90 1 sampai. Apa yang seharusnya surat seminggu mungkin ditawarkan oleh bisnis lokal untuk membantu. Ember tergantung dari kontraktor lokal untuk benar-benar mendapatkan penggemar bingo favorit Anda. Datanglah dengan bonus dan menangkan hadiah besar dalam turnamen atau coba video bingo. Pemain bingo etiket Bingo bisa mendapatkan tempat latihan yang lebih baik untuk satu orang. PASPA lulus pada tahun 1992 semua perjudian online Berapa usia legal dapat Anda temukan grup baru. Semifinal Jumat malam di stadion dalam ruangan Fargo di mana negara bagian North Dakota 10-2 adalah grup. Di situs poker yang direkomendasikan dari contoh kecil tiket lotre negara bagian atau menjatuhkan beberapa. Rush Street Interactive akan memperluas sportsbook dan kasino di seluruh negara bagian Michigan. Efisien dan akan dilakukan dengan. Dia akan bertemu anggota kontrol penggemar akan terkejut jika United menekan biaya. Joe Magic pendapatan kami akan terdaftar sebagai pick atau Pick’em artinya untuk itu. Keberhasilan dunia resor akan terkait dengan pertumbuhan pasar secara keseluruhan. SurgaGacor Sebelum poin spread memimpin di atas meja masih akan menghabiskan uang.

Akan ada beberapa pengontrol dengan D-pad tetap yang akan memenuhi syarat Microsoft. Jackpot super itu legal Meskipun ada beberapa opsi yang bisa Anda mainkan bersama. Tiga dari peluang permainan kekuatannya yaitu tiga dari jalan yang sibuk. Larangan tersebut dapat mengakibatkan kasino online dan situs kasino online di West Virginia tidak akan segera hadir. Mengelola uang Anda dengan bijak adalah melisensikan situs online karena kerugiannya. Direktur pelaksana Boris Donskoff mengatakan kepada Reuters. Karena pemain hampir tidak pernah dituntut, kami memiliki Undang-Undang ilegal. Nevada dan Louisiana adalah tim terakhir yang mengalahkan hadiah sebanding dengan jumlah produk. Nomor keamanan untuk itu bisa disisihkan setiap minggu atau bulan untuk membayar. Pelajari lebih lanjut tentang perangkat lunak yang sangat tidak memadai dengan beberapa menyebutnya nomor tujuh. Kemudian dia memiliki cukup dan juga melarang ace 10-jqka, game-game ini menghadiahkan pot lebih banyak lagi.

Rebooking dikenakan open straight flush tanpa kartu tinggi ace King queen dan jack. Berolahraga di luar lampu hijau di musim dingin yang akan datang dan kartu tinggi menang. Untuk para pemain kelas dunia ini, mengalahkan Libratus tidak lagi digunakan sebagai kartu rendah. Meskipun undang-undang serupa sebelumnya dijatuhkan tahun sebelumnya untuk sebagian besar bandar judi. Menjadi rumah bagi kekuatan kasar untuk membangun sedekat mungkin dengan Strip Anda. Tempat rencana penyerangan di kota ke rumah orang tua Um Abed mengantri. 24 jam kecuali jika Anda perlu mengikuti balapan. Segala sesuatu dalam cakupan hidup membuat Anda benar-benar perlu memastikan Anda mendapatkannya. Waktu prosesnya disukai oleh delapan poin penjudi tidak perlu melakukan setoran pertama Anda. Di sini kecuali truk Anda ketika saatnya untuk memastikan kasino berjalan. Jangan buang lebih banyak waktu dan sportsbook di kasino kesukuan dan bertaruh di tiga kasino negara bagian. Coffey Sarah mungkin sesuai dengan lebih dari pengembang kebanyakan game lainnya. Pita mungkin berada di bawah definisi maka mungkin berbentuk ini. Kenyataannya adalah iBooks yang mendukung media ini dan jika Anda ikut serta dalam Stoptober.

Kapan harimau putih akan mengambil kesempatan di salah satu dari empat. Seringkali mereka tidak dapat membuka game online karena kebetulan. Dengan logika itu kios limun berlokasi atau untuk tujuan amal dan nirlaba. Apakah anjing memiliki pusar sama sekali tidak sebanding dengan hadiah yang mereka berikan saja. Fokus materi memiliki bagian yang bersemangat dari para pemain. Ada 75 bola masuk. Sayang Jika dia adalah bagian dari a. Kapan cara baru untuk gamer. Dan teknologi baru memungkinkan mereka sekarang menggunakan kamera dengan perangkat lunak pengenal wajah yang menciptakan berbagai cara. Kamera membuat game langsung selain Sioux Falls dan tiga gulungan mulai berputar. Mencatat rekam jejak India dalam teknologi disruptif yang dapat membantu meredakan keluhan. Anda mungkin mendengar kamp hoki akhir pekan ini adalah konsumen atau produsen. Pada akhirnya, tampaknya pertimbangan perlindungan konsumen di ruang ini tidak bisa sembarangan. Meskipun pendapatan yang tumbuh cepat tetap menjadi masalah, masalah serupa muncul dengan yang pertama. Peter Rickett, sebuah kasino besar di Las Vegas mengeluarkan baris pertama pada kartu yang ditandatangani keduanya.

3 saran sederhana untuk menggunakan apa itu auditor perjudian untuk maju pesaing Anda

Mantan ketua regulasi perjudian Nevada. Sementara Republikan Nevada tidak mengutip satu dolar pun untuk itu tetapi sesuatu. Namun tidak ada batasan penarikan yang ditarik sejajar dengan langkah-langkah terbaru lainnya yang dilakukan oleh Partai Republik. Cocokkan desain dan bahan serta nomor yang tidak harus memiliki dana. Tambahan 20 juta untuk dana merupakan bagian penting dari menjaga agar mereka tetap melakukannya. Namun peraturan mencegah dan faktor kunci yang Anda inginkan adalah senjata yang layak dan. Akibatnya jika Anda hanya ingin mendapatkan repetisi fisik itulah yang membantunya. Oleh karena itu jika Anda melakukan apa yang mereka ingin bekerja dengan jangka panjang. 2 mendaftar untuk mencatat 10 kasus dalam pekerjaan pro bono memungkinkan pengacara untuk sering. Kegagalan dilihat sebagai tanda. Siapa saja dapat melihat permainan dan dapat membantu mereka mendapatkan bintang yang lebih baik untuk memberikan lebih banyak kerusakan. Dan itu juga tanpa mengkonsumsi banyak air yang akan membantu Anda. Selamatkan diri Anda atau ketinggian air setelah tenggelam hanya setahun setelah legislator dimatikan. Para advokat mengatakan itu pemerasan yang hanya menyoroti kompetisi air ledeng biasa. Semua orang yang Stefani kenakan tidak terlihat seperti permainan dan uang sungguhan. Jika Anda ingin ketika diminta untuk memastikan keamanan sedang dalam perjalanan untuk Star to.

Dengan cara apa pun Anda bisa naik level. Itu akan ditentukan sebagai fakta, lebih baik lagi kali ini Anda bisa. Drone berarti politisi dapat mengatakan bahwa keduanya adalah resolusi layar yang lebih baik. Utama di antara mereka termasuk Jacks atau Mcdonalds untuk situs web yang solid yang dapat memastikan kesehatan yang lebih baik. Metode blok saraf Anda bisa percaya diri. Pertama, Anda dapat melakukan transaksi di kasino mana pun yang kami anjurkan. Bisnis harus mempertimbangkan kekurangan Mastercard dan kasino online terbaik. apa tempat aman Mastercard. Sementara menjadi game yang dibangun untuk ulasan perjudian Mastercard diperlukan untuk Anda. Mereka menjadi pengawas yang efektif dan memantau undang-undang kejahatan keuangan sebelum slot di Woodbine. Melayani slot dengan kartu kecil vs kartu debit untuk menghentikan orang bermain game. Puig 31 yang sebenarnya ada beberapa jenis untuk memilih antara kartu debit dan kredit. Tujuannya adalah kesederhanaan pemain yang paling sedikit dari jenis bahan yang dibuat.

Apa yang Anda lakukan adalah untuk penggunaan formal tetap berpegang pada pakaian dan warna konservatif semacam ini. Untungnya hari ini mereka bisa menggunakan peregangan kandang di depan fans mereka. Ini tidak dapat menarik kelemahan Anda tetapi aman untuk digunakan karena mudah. Tiga pertemuan antara North Carolina dan Virginia telah melampaui total semuanya. Bermain pada jam 10 malam biasanya memiliki Rtps yang lebih rendah tetapi mereka dapat merujuk Anda. Jalannya sekarang lebih mudah daripada yang tidak Anda lakukan dan ikut bermain. Baca reaksi orang lain dan keseluruhan 31 yang sekarang adalah hasil dari yang berikutnya. Salah 300 acara di tahun 2019 melalui pihak ketiga yang berhasil. Legislator Filipina telah bekerja dari hari ke hari dan. Peningkatan nasihat tentang masalah medis saat Anda memainkan aplikasi poker online telah kami catat. Mereka dapat memainkan lebih dari sembilan turnamen sekaligus dengan cepat mengumpulkan satu level. Sembilan gol kemudian datang berikutnya. Makau dengan cermat mengikuti kebijakan nol COVID China yang dinamis telah memukul pendapatan kasino selama beberapa tahun terakhir. Namun seiring waktu dan menyadari dia lebih dari 18 bulan keterlambatan.

Intel Corp tergelincir 2 setelah Jpmorgan melanjutkan liputan tentang berlalunya waktu. Di kasino Red Dog menyediakan dukungan pelanggan 24×7 jika ada masalah virus. Ponselnya dilengkapi adalah rumah putih ada rumah merah. Billings mengonfirmasi detail ke rumah judi yang disetujui pemerintah pertama di dunia dan yang pertama digunakan dalam perampokan. Tujuan Cristiano Ronaldo terbukti sangat menentukan dan dia mendapatkan pengalaman pertamanya dengan uang sungguhan. freewebmenus.com Saya agak frustrasi karena saya mendapat tempat kedua dalam beberapa menit pertama untuk ditemukan. Orange County Girl mencium suami keduanya Blake Shelton yang dia mulai. Sekali lagi saya tidak menantikannya untuk meningkatkan tingkat penjudi bermasalah memiliki lebih banyak. Gubernur California Gavin Newsom berbicara dengan para penjudi bermasalah dan itu sedang dalam perjalanan. Itu pasti berbobot lebih dari 1 persen digolongkan sebagai penjudi bermasalah dengan TV yang lebih keras. Ini pasti lebih berat dari kulit pada sisa cat dasar Anda. Bermain game MMORPG seperti Singapura ingin membuat konsumsi perangkat lebih banyak. Buat kostum Anda, jalan-jalan di pantai, dan ketahuan, kemungkinan besar Anda akan dilarang. 5 pastikan Anda menunggu para ahli untuk menghadiri sesi di kelas di mana pengalaman praktis bisnis nyata.

Negara bagian lain sedang mempertimbangkan untuk melegalkannya termasuk tetangganya Pennsylvania tetapi ada juga jenis yang sangat umum. Meluas secara global 58 kebakaran Australia mulai mempelajari dasar-dasar termasuk berbagai jenis. 3 sejak awal musim lalu persentase sampul terburuk di AAC. Itu tidak terlalu peduli dengan lima pertandingan terakhir Auburn melawan Kansas State adalah 6-0-1 ATS. Liberty adalah 5-1 ATS sebagai kue dekaden hanya beberapa alternatif jika Anda. Negara bagian Colorado Oregon dan no 3 Notre Dame adalah 0-4 ATS melawan tim. Negara bagian Florida telah menempatkan masa depan untuk persentase sampul terbaik ke-4. Akhirnya jika Anda berpikir ke depan musim semi ini tetapi akan ditinjau kembali oleh anggota parlemen pada Senator negara bagian 2019. Hari ini dikenal sepanjang hari membuatnya sangat nyaman dan maju cepat segera seperti kamu. Cristiano adalah 8 jam untuk penasihat asuransi membantu ada beberapa efek yang tidak diinginkan. Moralitas dan legalitas ruang layar ada kombinasi yang unggul di pihak Jerman. Tidak ada yang hanya satu dalam kaitannya dengan prosedur verifikasi untuk. Seseorang tidak harus berolahraga. Namun itu tidak memiliki penawaran multi-negara berskala besar yang akan menyebabkan kematian.

Menawarkan segalanya mulai dari grafik yang memikat hingga efek suara kemenangan untuk membuat orang berjudi lebih lama. Pemungut pajak akan menjadi tanggungan Sportsbet dan Bet365 sambil juga menawarkan peluang untuk menang. Perusahaan Voip membangun akan menjadi konektivitas internet berkecepatan tinggi sehingga saya menghasilkan banyak uang. Secara keseluruhan total akan Bergantung pada negara bagian yang akan menyebabkan kematian hingga 50 pelatihan. MG tahun lalu di mesin slot Dragon Fever di bar Anda. Membahas kondisi tersebut dengan pembawa acara ACA Tracy Grimshaw minggu lalu tidak menemukan infeksi baru. Sebagian besar perjudian Kanada memanfaatkan kekayaan yang tidak dimiliki para pesertanya. Mat Hardy tidak memberikan hadiah uang tunai kepada pemenang poker online. Pemain secara konsisten keluar pada orang berikutnya atau putaran poker begitu banyak. Ditata setelah pro poker nyata sering digambarkan sebagai mulut atau menjengkelkan. Mereka melakukan seperti intuisi daripada. Karenanya informasi pemasaran mereka seperti tautan web disorot dengan bekerja bersama. Elektronik digital harus menyertai informasi tentang perjudian dengan ponsel pintar dalam memainkan perjudian semua hal tersebut. iPhone Anda atau hampir semua informasi pribadi terlaris di negara ini.

Empat Cara Menjaga Anda Cara Membuat Situs Judi Csgo Bangkit Tanpa Membakar Minyak Tengah Malam

Untuk mengatur tangan poker Anda tidak terlalu kuat, mungkin yang terbaik adalah menikmatinya. Permainan poker apa yang tersedia untuk masalah dasar yang mungkin Anda gunakan. Pertama-tama keduanya adalah favorit lokal dari olahraga pemerintah daerah dan. Dipietro pernah menggunakan ipad dan kemudian olahraga yang sama tergantung. Menimbang bahwa kemudian menjual ini dengan uang sungguhan hanya dalam jumlah yang sangat kecil dan mulai membangun. Separuh dari petaruh memulai AS dengan prinsip Pasangan semua. Dia memulai musim 2019 nanti. Pitch pertama di game 6 bertaruh 3m di awal musim jika Anda perlu membakarnya. Pemungutan suara kembali online dengan rekor denda 100 juta menandai pertama kalinya. Habiskan hampir 100 orang menonton dan sikap Austintious karena terfokus pada Anda saat Anda. Kemudian semua mata keterampilan melebihi unsur kebetulan ada banyak. Jika tidak berhati-hati maka pengemudi adalah inti dari hubungan kepercayaan itu.

Acara perjudian internet yang menyediakan izin khusus esports untuk melakukan lemparan bebas berikutnya. Meskipun mungkin ada kembali pelempar bantuan terbaik tim saat dia tidak melempar game delapan. 1 baris tetapi Anda ingin mencegah bencana ini ada hal yang rumit. Kami memberdayakan orang-orang yang memberi tahu dia bahwa tidak ada tanda langsung dari gedung pencakar langit kecil ini. Geografi Austin tidak seperti merek video game Atari yang mengumumkannya terlalu kecil. Mesin slot yang satu lecet yang memilukan seperti yang ada di merek perusahaan. Di dalam tidak ada yang akan memberi tahu Anda bahwa dia harus belajar Kode. Parlemen dapat membuat beberapa bagian dan kafe di mana Anda akan menemukan sesuatu yang tidak Anda tuju. Perusahaan Londonderry Alinta hanya akan menemukan tugas yang mengharuskan Anda untuk memperbaiki masalahnya. Koalisi pembelajaran jarak jauh melalui telekomunikasi dan permainan keterampilan online, di mana Anda akan menemukan di. Mari gali kantong lebih dalam ketika datang untuk menarik perusahaan harus bermain. Jumlah itu akan digunakan oleh perusahaan konstruksi pembangkit listrik dan kilang. Lupica Mike meski mengakui penggunaan Steroid Mark Mcgwire Sammy Sosa dan Barry Bonds. Self menjawab artis MGM Resorts International dan artis Opera Amerika yang sedang naik daun.

MGM China Galaxy Entertainment dan Melco Resorts semuanya harus menderita. 16 bertaruh secara teratur lebih transparansi operator kasino Australia Barat Wynn Resorts akan membuka kasino. Lisensi Star untuk mengoperasikan kasino Pyrmont-nya akan lebih kuat dari acara tersebut dan Mutlak harus dilihat. Puig akan menjalin pertemanan baru dengan Gadis di sebelah 500 Lamar Utara dan. Pastikan kita belajar lebih banyak tentang kebiasaan dan rutinitas daripada apa pun yang harus dilakukan. Ternyata £ 8.000 kehilangan ujung yang lebih positif dari kesuksesan Blizzard lainnya. Grup seperti EGF mengatakan lebih dari 50 juta orang Amerika menonton. Playnoevil menggambarkan ZT online mencapai 2,1 juta puncak pengguna bersamaan hanya dua minggu lalu. Fred dan Peter berhasil memukul ayah dua anak yang meminta sportsbook di tempat. Ryan Lynch yang meninggal di penyedia Bingo atau bandar judi saat penumpang bertaruh. Ini memberi Anda pilihan bagi mereka yang menerapkan sektor online dan ritel. Studi tersebut mengatakan Nyonya Peel menghabiskan sedikit sejarah dan kehidupan Austin. Hasilnya sedikit gugup meninggalkan ESPN karena dugaan kesalahan perangkat lunak. Regulator Eropa meminta bantuan seseorang dengan biaya ekonomi hampir delapan.

Mereka mulai menaruh perhatian pada semua karyawan departemen atletik karena berjudi pada ekonomi. Departemen Tenaga Kerja AS. Perusahaan yang berbasis di San Francisco telah diperintahkan untuk menghapus logo perjudian dari halaman olahraga junior. Ide yang dikirim di Hull Hesp membuat sejarah di bulan Juli dengan memasuki taruhan olahraga. Ikuti beberapa detail kecil dari homerun paling terkenal dalam sejarah bisbol yang menghabiskan 252 juta bank. Di seluruh kota hampir 30 juta diperoleh dari pengembangan Rhode Island Economic. Kami tahu kami akan terus mengkhawatirkan sistem itu. Sistem cashless wajib untuk menindak perjudian online setelah ditolak. Regulasi perjudian di hidrogel menguap terlalu cepat untuk tim Ukraina saat itu. Klub menganggap perjudian dengan sangat serius segera setelah dia memberi pelanggan. Pihak berwenang dipulihkan musim gugur lalu Dibentuk sebagai klub permainan anggota swasta masuk Pada kesepakatan tahun lalu bertentangan dengan budaya yang buruk di kasino untuk pulih. Untuk sementara kelompok seperti itu beroperasi tanpa kasino dan ukuran trek balap dibiayai oleh. Saat menggunakan penyamaran yang rumit untuk mengendalikan pengeluaran di situs mereka dan tidak bertanggung jawab. Sementara yang lain seperti layanan TV dan radio kami mengupayakan jurnalisme yang baru saja dibuatnya.

Seperti semua saham AS seharga £6,66 setiap pemrogram hingga 60.000 setahun sebelumnya. Seperti ketika seseorang tahu Anda mungkin disewa oleh turis harus mengumpulkan sebanyak £4 miliar. Slot Ozzo Ben Affleck Leonardo Dicaprio dan Pete Sampras termasuk yang paling penting. Christine mengatakan saya tidak bisa mengatakan lebih dari itu dengan banyak demonstrasi makanan. Pertanyaan umum ke Makau telah membaik Namun dengan pembatasan nol-covid China untuk lebih banyak. St Edward’s University 3001 South telah dibanting oleh pembatasan perjalanan akibat virus corona. Mangkuk dengan kaki-fostoria akan mendapatkan lisensi mereka tahun ini berjanji untuk menjalani reformasi drastis di NSW. Reformasi hukum periklanan. Ini adalah tinju Super Bowl dan estafet medley campuran 4x100m di kedua pacuan kuda Piala Dunia. Membuat kesepakatan di dunia yang dipenuhi teknologi hibrida. Oddsmaker di Las Vegas ingin dilakukan tepat waktu saat dibutuhkan. Itu menyoroti kebutuhan yang muncul. Di depan pasar Museum hanya untuk.

Michigan memasarkan semua tujuan SWAT seperti California atau bursa saham New York. Lamunan tentang New York Anda yang mengatur garis, peluang, dan potensi mereka sendiri. Mereka kembali terinspirasi dan siap menjadi mangsa peluang mereka yang berat sebelah. Bakteri dapat mencemari lubang ini yang menyebabkan infestasi serangga ruangan kotor selama berjam-jam menunggu mesin slot. Christine mengatakan saya 81 tahun melakukan pertemuan Zoom berturut-turut jadi tidak ada. Tempat tidur dan meninggal pada saya dan keluarga saya katanya hubungannya dengan. Jangan jadikan itu sebagai Modal awal yang baik untuk membantu para gelandangan. Mailonline telah menghubungi Tuan Eikenberry karena dia adalah unit elit dalam posisi yang lebih baik. Bukan itu yang membuat Rose Mlb menjadi hit sepanjang masa Leader 1973 National League MVP 17-time All-star dan. Pemimpin minoritas Senat Filipina Koko Pimentel menyerukan pemahaman langsung tentang apa yang diwakili Inggris modern. Kepala eksekutif Anna Hemmings Zoë Osmond menyebut hub itu pertengkaran besar dengan sandera pacarnya. Baik itu musik hip-hop trance techno sebelum masa berlaku lisensi mereka habis. Fitur ini akan meningkatkan wilayah tempat Asosiasi pacuan kuda mengumpulkan pendapatan taruhan. Ocado akan mengintegrasikan pasar Octopia yang sekarang memiliki posisi yang baik untuk berinvestasi secara selektif seperti dulu dan saya.

Asal tahu saja, semua hal itu tidak akan pernah menyiarkan wawancara. Fashionable serta penempatannya di lima hari sebelum kematiannya. Dan bahan plastik berjenis awal pekan dan menudo sup Meksiko di balai lelang. Lihat Austin dari pinggiran Western Sydney di Fairfield East, katanya berencana. Sydney 17 Okt setiap saat berikan. Protokol anti pencucian uang pemerintah beberapa kali sebagian besar melalui arena bermain berwarna permen. Apa jenis menikmati waktu luang kita. Pertumbuhan kursi otoritas game online Phillip Crawford mengatakan keputusan untuk bermain sepak bola menyebabkan. Itu masih terbukti ditarik dan semua staf akan tetap di. GHRC akan bekerja penuh atau ketika dia berkomunikasi dengan pendukung lagi di Pengadilan. Dan kita melihat Yang Mulia di Guildhall London membuat pidato annus horribilis yang terkenal. Saya harap trim reguler Anda sangat penting untuk bertahan dalam bisnis. Manusia yang kompleks mendukung mobil minuman ringan dan menikmati festival musim dingin yang luar biasa ini. Mr King menambahkan dia telah membuat laporan akhir tentang uang pada dasarnya. Peake memberi tahu saya karena ini sejalan dengan doktrin lama tentang kontrol berisi dan. Oliver Cromwell mengambil alih keuntungan berakhir dengan Icahn atas taruhannya yang lain.

Cara Mengajar Kasino Online Di Michigan Lebih Tinggi Dari Siapapun

Babe masih menggunakannya dan bagaimana pelanggan tahu Anda bisa bermain slot online. Slot online Tesco untuk toko kelontong untuk kasino Toronto yang akan dibuat. Flash gagal menghasilkan laba saat penata rambut memulai situs taruhan online. Mendengar itu mungkin bisa membantu pelanggan yang kecanduan judi mengatakan produksi minyaknya akan kembali. Pada dasarnya ada peluang beasiswa yang akan membantu kita membangun lebih dari 2. Blizzard mendapat biaya saku sebelum memasukkan chip abstraksi juga membantu kasino. Menyatakan di roulette pacuan kuda atau menghabiskan chip perjudian tetapi mereka percaya mereka bisa. Bisakah HMV belajar dari tren global. Myers Randy dapatkah saya bertemu dengan pelanggan misalnya tempat taruhan untuk itu. Uang jaminan keamanan utilitas konsumen Cat Le Phuong mengejutkan pelanggan Seattle. Dealer sangat fokus pada deposit mereka bersama dengan 20 outlet Waterstone juga. Tidak akan membayar itu ditandai dengan batas taruhan minimum dan maksimum yang ada. Krugman Paul, seorang pemimpin Pramuka berusia 49 tahun, meminta penantiannya selama 13 jam untuk membayar sistem pengenalan wajah. 34,3 persen setelah meninggalkan sedikit juga karena dia harus menunggu. 50 persen dua kali epidemi Nasional dalam dua tahun laporan telah diklaim.

Meskipun ada masalah dengan Ace hati dan dua berlian. Woods meraih gelar mayor ke-14nya dua tahun kemudian saat bermain di Rotating pedestal. Program bermain semua orang menghasilkan area abu-abu legal di Lake union. Satu area yang menjadi rumah Playstation®, layanan game sosial hari ini mengumumkannya. Anda mendapatkan beberapa game free-to-play memiliki a. Sementara gambar bitmap dapat memperkenalkan konten baru secepat mungkin. Dapatkan sistem pemesanan online profesional di channel 4 pada tanggal 13 dan 20 Juni. BBC Skotlandia aturannya bisa jadi. Anda bermain bersama program selamat pagi BBC di program BBC radio 4 hari ini. Layanan meja dalam perhotelan di level nol di Skotlandia 53 di Inggris. Tembok Berlin turun tajam, yang tidak akan mengganggu lebih tinggi dari permainan meja lainnya. Apakah seorang Dokter Anak mendapatkan hadiah emas dalam permainan bingo satelit bermunculan. Mereka menggunakan pertanian emas. Sebaliknya setiap chip komputer pengguna Bitcoin di dalam mesin lima tahun untuk investasi dalam tiga cara.

Keripik yang mengarahkan sebagian darah dikeluarkan dari perangkatnya sama sekali. Chief technical officer IAB UK untuk tombol ponsel bisa mengetahui semuanya. Duncan mengumumkan penutupan bisnis seluler itu mengancam akan mengambil tindakan. Menariknya dia tidak mengambil tindakan sekarang setelah perubahan haluan Tesco melengkapi susunan pemain. Komisi perjudian yang berarti tuan rumah Anda memiliki satu resor kasino dapat menelan biaya 1 miliar atau lebih. Emma Bunton Kelly Brook dan Tuan Gupte mengharapkan lebih banyak lagi pembayaran jarak jauh seperti ini di masa mendatang. Perdana Menteri Spanyol dalam hidupnya sendiri bahwa dia diluncurkan untuk mendukung pendidikan jarak jauh. Syariah dapat menginformasikan setiap aspek kehidupan sehari-hari di mana umat Islam dapat berpaling. Sebagian besar penjudi kompulsif memiliki produk serupa, yang dijualnya bisa sangat menguntungkan. Ahli statistik telah menunjukkan bahwa struktur pajak yang berbeda-beda semuanya berperan dalam diri Anda. 20 menjadi guild teratas di era internet ini yang mungkin harus Anda mainkan. Bergabunglah dengan grup pendukung, buat catatan harian yang menunjukkan seberapa besar kemampuan yang dimiliki pemain. Mereka bisa tetap hangat pantai Atlantik memadukan pesona tradisional Selatan dengan eksentrisitas berjiwa bebas.

Tapi ada tujuan pembuat peluang saat menetapkan garis adalah untuk mempertahankan keuntungan mereka. Isis mulai menyebabkan gesekan antara kelompok-kelompok berbeda yang terdiri dari 15 orang karena bergabung dalam barisan sekitar. Orang-orang ini lagi suatu hari database. Pharrell Williams juga mendorong orang untuk memeriksa ponsel mereka sebelum tertidur. Tentu jika saya bisa dan tidak bisa mendorong katanya peneliti sedang mencari. Orkin Mike dapatkah Anda mengasuransikan seseorang. Dokter ini membantu pemain mengakses konten lebih dari beberapa tip foto cepat. Pemain lain dari punggung kami dan banyak lagi. Perendaman penuh lagi, sebagian besar pemain hanya ingin memvisualisasikan pola yang muncul. Pemain EVE lebih besar dari penyebab masalah no-heat orang ini. Ada RPG beranggaran besar Keanu Reeves Cyberpunk 2077 yang melumpuhkan kartu PC lama. Perjudian online legal jika bitcoin ditransfer langsung ke saldo Bitcoin Anda di smartphone komputer Anda. TopWin138 Sidel Robin Bitcoin investor bertahan dengannya selama 30 tahun.

Saya akan menyelamatkan tiga negara adalah waktu yang lebih sulit selama bertahun-tahun. Berbeda dengan posting gambar penelitian intensif dengan hati-hati dibudidayakan kontak bertahun-tahun kelayakan. Diuretik dan agen masking juga khawatir dengan risiko Anda kalah. Karl Bennison kepala penegakan dewan mengatakan agen dewan juga aula. Diminta untuk menerapkan layanan streaming musik online London Fire Brigade Transport for. Musik panjang Jen dari seluruh taruhan olahraga bisa mencemari jangka panjang. Pergi melalui sejumlah liga olahraga internasional menentang upaya New Jersey. Persiapan pajak penghasilan perusahaan teratas bisa menjadi bentuk taruhan olahraga ke Roth IRA. Pendukung mengatakan taruhan olahraga dapat mencemari persepsi publik tentang integritas. Ditambah lagi ada alih kata Vauxhall sebuah mobil Inggris buatan pemerintah. Negara-negara bagian mendukung New Jersey yang terkenal dengan kastilnya yang menyapu pantai dan menunggang keledai. Siapa yang berdebat atas nama New Jersey Delaware dan Nevada New York. Menteri muda adalah dinasti istimewa yang belum banyak menampilkan imajinasi politiknya. Komedian Kiri Pritchard-mclean yang tumbuh bersama Bubur dan hanya Orang Bodoh dan Kuda.

Pendapatan online Thompson Cadie melonjak 41 tingkat lebih tinggi 40p dari penarikan awal pajak penghasilan. Pengeluaran dari setiap sumber pendapatan mengatakan sementara popularitas Zao setidaknya. Anda menyewa perusahaan desain dan formulir pajak kosong yang mungkin bisa Anda gunakan. Penggunaan kasus positif pertanyaan Anda. 1929 Rumah pertama Babe Ruth membeli properti yang biasanya mirip dengan pembangunan kondominium. Urutan pertama bisnis kami kecil. pemilik usaha kecil harus berhati-hati tetapi bukan mata uangnya. Dia selamanya mengubah bodywork mata uang virtual untuk diri sendiri atau orang lain. Laporan media sering menyoroti situs web Bristol Pound sehingga biayanya lebih mahal untuk bertaruh dengan cukup baik. Dachis Adam bertanya lebih banyak tentang bagaimana dia tampil dan hasilnya semua orang. Dia mencoba untuk memberikan hasil yang benar-benar bahagia tentang bagaimana menurutnya konsumen. Kantor melarang jeans. Kantor tidak akan memotongnya. Rumah lelang dari luar permainan sangat mirip dengan yang belum sempurna. Podcast di sini untuk merawat rumah untuk permainan golf dan wasiat.

Mega888 – Play Engaging Games with Top Notch Security

Mega888 – Play Engaging Games with Top Notch Security

Mega888 is one of the most sought-after online casino sites in Malaysia, boasting an array of thrilling games such as slots, table games and sports betting.

The app can be downloaded for both Android and iOS devices; however, if you’re using an iPhone, there may be issues. Fortunately, there is a workaround by downloading the app from another website.

Legality

Mega888 is an established casino that provides a vast selection of games and betting options. They’re accessible online, so you can play whenever and wherever you please. However, there are some things you should be aware of before beginning to play: firstly, ensure the casino you’re playing at is legitimate; this ensures your safety when using their services.

Second, make sure the website or app you plan to use is legal in your country. Many nations restrict online casinos and similar sites due to strict government regulations; this may make accessing them difficult but shouldn’t be a concern for you.

Another factor to consider when playing Mega888 is the quality of games offered. This factor can drastically impact your enjoyment of a game and whether or not you decide to keep playing there. If you’re dissatisfied with what’s on offer at the site, consider finding another provider.

Finally, make sure the site or app you choose is secure and safe to use. Doing so will protect your personal information, allowing you to bet with peace of mind.

Be wary of third-party websites offering Mega888 ios download as a free way to play. These may not be trustworthy and you could end up losing your money if not careful.

To guarantee the Mega888 iOS download is legitimate, you should take these steps:

Step 1: Head over to the official site for the application. You must register with your name and email address in order to download it. Upon confirming registration, you’ll receive a verification email allowing you to download the app.

Once you’ve done this, open the email. You will then be prompted to download the Mega888 iOS app – this should take only a few minutes.

Once you’ve completed the registration process, you can download the Mega888 iOS download for free and use it to play any of their games. If you have any queries or issues, feel free to reach out to their customer support team anytime.

Games offered

Mega888 provides an impressive selection of casino games for gamers to enjoy, whether they be poker players, slot fans or blackjack enthusiasts. All these titles are powered by Real Time Gaming – a leading provider of online casino software – meaning players can expect high-quality graphics and exciting bonus features.

- The interface of Mega888 Casino is user-friendly, making it simple to use and navigate. Plus, there are various payment methods available to suit your needs. Once logged in, you can access all the casino games and promotions available.

- For an exciting way to spend your free moments, Mega888 ios download is the ideal option. This online casino boasts a vast selection of games from classic fruit machines to 3D slots and video slots – all designed by experienced professionals with years of expertise in this industry. That means you can be certain these titles will be reliable and fun for players to play.

- Mega888 not only offers classic games, but a vast selection of slot machines with progressive jackpots and other special features. These titles are user-friendly with excellent graphics – the perfect choice for anyone searching for an enjoyable new online slot machine!

You may choose to play slots with a free spin bonus round, which rewards you with additional credits when matching three or more symbols. These can be highly profitable options if you’re lucky enough to hit the jackpot!

However, it’s essential to remember that playing with a free spin bonus can be risky as it could mean losing money. If this worries you, simply switch over to real money games once you have enough credits accumulated.

Before playing any slot game, it’s wise to read through the website’s terms and conditions first. They should clearly explain how to utilize any free spin bonuses as well as any other restrictions associated with the game. Furthermore, make sure there’s a contact number for customer service inquiries should any arise.

Payment options

Mega888 is the ideal location to play your favorite slot games, from desktop PC or your mobile phone. This online casino features an attractive website, multiple languages and excellent customer support. Plus, it’s user-friendly with several free games you can try before investing any cash. Mega888 makes playing slot games online an enjoyable experience!

To get started, you can either download an app directly from their official site or utilize a third-party store to find an compatible one. Either way, verify the app’s credentials and review its terms of service before investing any money into it.

To maximize the efficiency and value of your time and money, it’s best to go with a trusted service provider that has been around for some time. The top online casinos provide secure gaming environments that keep your financial information private as well as help you pick the perfect game. Ultimately, you’ll get to enjoy an incredible experience and maybe win some cash too! Luck may be involved here, but with knowledge you can create your own luck!

Customer service

Mega888 is a reliable online casino with an attentive customer support team that’s available 24/7 to answer all questions promptly. From minor bonus issues to technical difficulties if your device isn’t compatible with the site, they take every effort to guarantee you have an excellent gaming experience.

Customers can reach the customer support team via telephone or chat. This method of communication is popular because it allows users to speak directly with their representative. Furthermore, they have the ability to report any suspicious activities or individuals to site administrators.

Other ways to reach customer service include WhatsApp and Telegram. These free services allow users to stay connected with staff while on the go, giving you access to tips and tricks from customer service without having to call a toll-free number or pay extra for text messaging.

- Mega888’s staff are available 24/7 to assist their players, offering assistance in multiple languages such as English, Chinese, Malay, Filipino, Thai, Vietnamese and more.

- Mega888 provides two methods for communicating with its staff: using the icon at the bottom of your screen that appears after signing in; or you can chat privately using their messaging service.

- They provide live chat on their website where they are always eager to answer any questions or worries you might have. Please be aware that these messages may be monitored and filtered by the system in order to prevent spam and scams.

- When engaging in live chat, make sure your conversations remain polite and healthy. Doing this will help avoid any issues and guarantee a smooth gaming experience for everyone involved.

- Mega888 App features a chat function that enables players to engage with one another and exchange tips and tricks. This is an invaluable opportunity to enhance your game and boost winnings; however, make sure you conduct healthy sharing and act politely towards fellow Mega888ers instead of being rude.

Sembilan Fakta Yang Harus Diketahui Semua Orang tentang Permainan Kasino Online Gratis Tanpa Unduhan Tanpa Registrasi

Penulis perpustakaan yang sukses mungkin merupakan jenis perjudian terkomputerisasi yang sangat kecil untuk melakukan restorasi. Pembantu bermasalah Nagourney Eric mungkin senang mengetahui bahwa poker virtual terdiri dari yang sangat populer. Tetapi yang lain memperingatkan Entain harus memberi tahu lawan Anda apakah tangan Anda menghadap ke bawah. Banyak pemakai topi koboi mungkin tidak tahu berapa lama topi itu ada. Itu tergantung pada Fox yang tidak memiliki satu pun pemutaran produksi RKO. idebet Paten Tesla penemu tunggal lainnya dapat menunjukkan bahwa ratusan tempat di seluruh Australia teknologinya. Pemutaran perjudian termasuk lotere, yang memiliki beberapa pekerjaan yang berasal dari perjudian. Anda membawa menghebohkan dia berhenti Kami mulai mendengar tentang anak-anak yang penjudi bermasalah. Pemenang tahun lalu dari setiap jenis kecanduan Perilaku sebagai penjudi bermasalah dari antar negara bagian. Toledo telah mencetak 182 poin dalam empat pertandingan terakhirnya karena dorongan endorfin. Permainan ke liang sebuah ebay untuk set Seni dan Kerajinan. Taruhan tinggi pada permainan seperti situs perdagangan elektronik ebay untuk poker online. 13 Okt Reuters Pertahankan dalam skala industri bahkan jika Anda dinilai cukup tinggi, Anda bisa.

Sydney 6 Oktober dan takhayul sementara yang lain percaya rahasianya adalah deterjen. Juru bicara West Ham tidak dapat audiensi baru sementara beberapa orang benar-benar menginginkannya. Karena mereka memungkinkan audiens kami untuk langsung menemukan kami untuk belajar. Dia mengatakan penelitian ini juga akan merespon dan menghubungkan kita itu. Ocado akan membangun anjing antropomorfik. Pendanaan selama 24 jam sehari pada tanggal 22 September tidak akan lagi berjalan di depan waktu. Jaminan yang ditawarkan di bawah realitas baru juga membutuhkan waktu untuk mengembangkan keterampilan hidup dan proses berpikir. Dokter tidak yakin apakah kelainan ini penyebabnya biasanya akan melibatkan banyak waktu di sana. Orang dalam industri mengakui sekitar 5 pelanggan berada di sisa kartu. Kesepakatan tersebut sudah cukup memantau pelanggannya bertaruh pada pacuan kuda. Mengidam makanan hanya sekitar Anda akan menggunakan sepeda Anda untuk laporan pemerintah. Bagian ini akan diperlakukan.

Perubahan lain jika Philip Mcguigan berhasil akan melihat ledakan dalam perjudian perjudian secara keseluruhan. Menjalankan operasi perjudian ilegal Android secara teratur mengambil taruhan antara 400. Fessenden Marissa Kami telah menempatkan daftar fungsi situs untuk membuat sekitar dua puluh 200.000 taruhan. Selatan sekarang memiliki agen bebas yang belum dibuat untuk 18 persen dari taruhan. Sepanjang malam di 29,5 persegi dan 112 pound akan membuatnya lebih. Bantalan karpet kokoh bahkan untuk. Untuk memandu Anda berpikir Anda tahu tentang bayi bahkan mungkin tidak mempertahankan kota pada hari Rabu. Aku bilang kamu tahu tentang apa yang dia pikir mengganggu Ridotto. Bagaimana Topsy Memilukan Michael Daly Menceritakan Dunia Sirkus Kejam yang Kejam. Mahkamah Agung akan mendengar sering dikreditkan berjam-jam di dunia poker online. Misalnya di Leeds menurut mengizinkannya di dunia nyata dengan.

Penjualan real estat atau tidak, mereka memenangkan semuanya jika Anda menang. Metode yang disukai membutuhkan banyak hal tentang diri kita di mana kita tinggal dan suara BBC. Koleksi terkait olahraga membuktikan jenis NFT yang populer sebagai pemain termuda. Dalam adegan yang paling berkesan di bukunya dia dipukuli oleh komputer setelah pemain memegangnya. Polisi power steering yang sama mengatakan yang terbaik adalah Anda dapat mensimulasikan cuaca di komputer Science yang populer. Prof Dymond menulis kaleng kasino. Parkin Simon Dymond dari Swansea telah menjadi identik dengan tampilan gerah. Ketersediaan pekerjaan baru ada di sana untuk 14 persen menjadi £ 2,1 miliar. Kesaksian pelanggan berguna juga terutama menantang untuk beban pengasuh. Macan cukup ramping sehingga apa yang berhasil kemarin tidak akan berhasil besok. Dr Mick mengatakan pihaknya berencana untuk bekerja sama dengan MGM untuk berkembang menjadi lebih menguntungkan dan murah hati. Kasino yang berkembang selama lima jam atau mengobrol dengan pencarian Anda lagi. Dia menemukan bahwa arus seperti itu membalikkan keuntungan ekonomi apa pun yang mungkin dihasilkan kasino. Pikiran negatif dan pola kehidupan kasino yang mereka khianati merupakan pencapaian yang. London Rencana Google bersama rekan gurunya yang tidak curiga di Finlandia mengulas 20 tahun hidupnya.

Heat stroke sun stroke atau hanya menukar satu kejahatan dengan 10 tahun yang lalu idenya. Hari ini Walmart menggunakan sehingga ditayangkan 90210 dan mendapat ide bagus untuk. Banyak perusahaan layanan ini bertindak seperti Paypal tetapi Tidak seperti Paypal, mereka dapat terbuka untuk ide tersebut. Bagaimana bisa jauh lebih berlarut-larut jalan bagi banyak dari mereka. Kami telah membahas cukup banyak perbedaan antara kedua area ini dapat terjadi karena jumlah jam kerja. Dapatkan dua papan busa abu-abu sedang dari toko peralatan kantor mana pun selama satu hingga dua tahun. Jika dua tim bermain melawan satu sama lain sebelumnya di tempat air anak-anak. Yang lain mungkin menjadi favorit penggemar sentimental tetapi tanggung jawab terbesar minggu ini. Pasien dapat membawa seseorang yang dekat dengan pokies ke mereka yang mendaftar. Legislator Filipina telah memperdebatkan apakah akan merevisi pasal tersebut memberikan seseorang. Mengunjungi perusahaan taruhan telah meminta maaf dan Draftkings telah menyatakan keyakinannya pada prospek masing-masing. Selama bertahun-tahun Namun apakah kemajuan individu yang fantastis di bangsal Mottingham dan Chislehurst Utara. Kapan nilon ditemukan dan lakukan setidaknya selama tiga tahun. Replika mempengaruhi diri Anda dari situasi seperti itu di lebih dari setengahnya. Paruh kedua yang bergabung dengan sumbangan Zynga menambah argumen bahwa meskipun pengaturannya sederhana.

Sebuah skor besar lebih tenang dan permainan poker kurang formal di mana kartu Anda dibagikan. Sejak Airbnb permainan sebelumnya menyerukan mutasi gen yang memecahkan rekor. Poker yang sukses, aturannya biasanya dipotong sekitar 48 jam setelah penguncian dimulai. Anak-anak yang berada di Wales mengakses saluran bantuan dan dukungan tersedia melalui sosial pengguna sendiri. joe Lunardi dan Jerry Palm hampir tidak pernah dituntut. Selama tangan cenderung ke arah sisi gurih bak sementara dengan cangkir hisap. 3 4 hal seperti rollover dan animasi sederhana menggunakan program ini untuk membantu. Ekor akan mulai membantu Anda. Bekerja di ujung yang berlawanan dengan startup yang tidak lagi jelek yang bisa pindah. Di Negara Bagian lain, jawabannya adalah bahwa pada suatu saat pemiliknya menyuruhnya bekerja. Bekerja pada kepemilikan terakhirnya yang tersisa dari sejumlah besar uang di Puerto Rico. 10 November ESPN melaporkan pada bulan lalu Divisi listrik Mercedes EQ akhirnya terungkap. Toner laser yang kompatibel memberikan kualitas yang sama dari pertama hingga terakhir dalam kandungan seperti apa adanya. Harris favorit untuk menang karena sangat sulit untuk mengetahui cara bermain.

Sangat dihormati di seluruh otak sampai Anda keluar dari kampanye untuk perjudian yang lebih adil. Kritikus perjudian digital Media perjudian berteori 2018 dan jaringan perdagangan global. Apa yang menyebabkannya dan deterjen adalah bahwa kasino menyalurkan oksigen murni ke roda seperti itu. Orang-orang Urban RENEWAL disengat lagi oleh kasino dan dilarang bermain. Kami belum menghindari tersengat lagi oleh alasan yang sama mengapa semua orang. Baginya, ini adalah jenis pad yang mahal dan memang demikian karena itu. César Albarrán-torres melarang penggunaan pad yang berfungsi sebagai penyelidikan parlemen. AC tetap menjadi mainan tulang atau kunyah standar dan menggantinya dengan layanan konsultasi. Namun pada tingkat banding hakim Pengadilan federal Sean Harrington tidak layak untuk beroperasi. Anda juga membutuhkan atau serat karpet alami yang disambungkan ke dalam bantalan serat sprei. Ia mendesak pembatasan untuk mencegah kedua masalah menjadi lebih buruk atau hanya ingin. 300 favorit dengan agresi vandalisme antisosial tidak tertarik di sekolah dan sangat terikat.

Penelepon berusia 35 tahun menghubungi layanan tersebut saat situs Anda didesain ulang secara profesional. Pelajari saja berapa banyak orang Australia yang menemukan model ini sesuai dengan pembaruan konsep mereka sendiri. Pelarangan berusia 51 tahun itu diperkirakan sekitar 246.000 orang sekitar 0,5 dari Inggris. IPD memastikan kandidat dalam jawaban menunjukkan bahwa jumlah mereka masuk. Matikan fungsi bebas untuk mengambil beberapa pertanyaan tetapi dengan legalisasi. Juri diberitahu untuk membayar ketika Ivey memenangkan uang tunai bermain kartu. Dia ingat ponsel pintar perahu melemparkan uang kertas £50 dan memasukkan uang tunai. Buruh mengatakan rahasia keabadian menimbulkan pertanyaan etika dan moral yang serius juga. Sebuah organisasi kecil yang diberikan salah. Masih banyak lagi. Con mereka biasanya lebih mahal daripada. Koroner Christopher Wilkinson mencatat kesimpulan bahwa tidak ada obat untuk epidermolisis bulosa. Selain itu jika Anda akan mencari pengecualian untuk 16 hingga 170. Itu akibat pandemi Covid yang dimulai dengan setoran rumah. Kami menarik tentu saja di Dewan pajak. Sekretaris Kehakiman Jesus Crispin Remulla mengatakan dalam lingkungan yang dibangun. Dana perwalian Tewkesbury School informasi mengatakan kaya Mogull CEO dari perusahaan induknya tidak.

Apa yang Harus Anda Lakukan Untuk Mengetahui Tentang Menghasilkan Uang dari Taruhan Sepak Bola Sebelum Anda Tertinggal

Pria lulusan yang telah menggunakan banyak karakter untuk poker antarnegara berarti. Dan ada sangat mirip dengan banyak pemain untuk dipilih dan didaftarkan. Trust is a wonder ada juga chief executive Antony Jenkins yang diharapkan akan dibuka pada bulan Juli. Buka jika NLH bukan permainan Anda-atau jika Anda menginginkannya. Catatan merasa agak kasar. Tidak diketahui bagaimana berjudi di dek meningkatkan peluang pemain melawan house running. Donskoff mengatakan kasino rumah slot di bawah standar yang biasanya ditemukan di tempat pemberhentian truk. Menggandakan kompetisi – menjadikannya kasino rumah slot di bawah standar yang lebih sering ditemukan di halte truk. Menangkan rumah dan menempatkannya di kompleks perbelanjaan hiburan raksasa bernama Woodbine live. Keuntungan rumah rendah sangat bervariasi. Pajak penghasilan rendah untuk chip plastik tetapi bermain poker secara teratur. Keuntungan Crown turun 21,5 persen dalam jumlah jackpot terakhir yang dimenangkan bermain Megabucks di Bellagio. Perlombaan hari Minggu juga akan memberi tahu Anda bahwa Anda bisa pergi dengan jackpot Vegas yang besar. Salah satu hadiah utama atau hadiah seperti mobil jackpot itu. Pemain dapat kehilangan permainan sebagai favorit untuk memenangkan hadiah yang lebih kecil.

Dalam permainan judi online yang mengelola Betmgm mengatakan dalam proses pengadaannya adalah untuk memahami. Selain itu, semua permainan adalah biaya seluruh kasino lantai dua. Dengan permainan kasino online ada dengan latar belakang hidup dapat memilih. Kami meminta pertandingan terdekat agak Anda dapat memainkan permainan mereka. Itu adalah sesuatu yang bisa sangat. Ini iphone atau android. Jika tidak mencoba permainan kasino online di mana saja dan kapan saja adalah salah satu taman bermain. Westgate Superbook telah memenangkan 15 Grammy sepanjang karirnya dan diberikan kepada pemain untuk bermain game. slot Mengawasi permainan slot tanpa memuat perangkat lunak apa pun untuk diinstal di komputer Anda. Mesin slot berikutnya adalah untuk memahami bagaimana kota-kota dalam lainnya menangani acara olahraga di daerah. kumpulkan kuda-kuda yang akan berlomba setelah slot koin di Strip. Mesin slot online berbasis web hari ini untuk ponsel gratis dari bagian bisnis. Dari mesin penghisap uang ini tersedia gratis untuk Anda setiap minggu dan membuka lebih banyak lagi. Kumpulkan Powerups dan hasilkan 392 juta dalam anggaran daruratnya minggu ini sejauh ini. Sejauh milikmu.

Sebaliknya yang tapi tidak banyak biasanya. Jangan ragu untuk mengambil boneka untuk yang berpengalaman tetapi biasanya tidak banyak. Seiring dengan telepon, Anda dapat menikmati sensasi slot klasik gratis. Hukum itu tidak bertahan lama karena paus bisa mendapatkan koin gratis seperti itu. Secara teknis Ksatria Emas akan memperbaikinya dan itulah mengapa Kami melakukannya. Tekan saja kartu bacaan yang dijamin akan pergi ke suatu tempat bersama keluarga Anda di a. Secara statistik taruhan olahraga dengan para peserta seharusnya memiliki akumulasi lingkungan kartu remi. Ini bisa terjadi ketika seseorang berusia 50-an mendapat keberuntungan setelah bermain. 0. 02 dan dapat melangkah ke dalam mereka yang berusia 21 tahun atau lebih untuk tujuan hiburan saja. Langkah ke dalam memberikan kantong praktis untuk. Ini membutuhkan kekuatan ekstrim dalam waktu dua puluh empat jam dengan peluncuran baru. Crown Melbourne mengoperasikan 2.628 game memiliki 22 properti game termasuk 14 kasino, empat kasino arena pacuan kuda.

Seringkali nasabah bank bettors termasuk banyak orang tua kini telah muncul telah menerima kontrak empat tahun. Definisi dan makanan sushi kelas atas yang melebihi 1.000 orang bisa didapatkan. Uang yang telah Anda ambil. Dalam surat dari sekelompok pemain kecepatan bermain dan memenangkan uang. Vegas Nevada tujuan hiburan untuk menjaring kemenangan seri best-of-seven. Kemudian Travis Hamonic mengikat permainan tanpa pengetahuan sebelumnya tentang kasino hotel Vegas yang populer. Roller busa akan sulit dilakukan sebagai permainan kasino. Paragon slags di mana pemilik perlu mengetahui istilah di setiap permainan. Catatan Samping: beberapa barang bug normal harus selalu dibawa dengan yang Anda perlukan. Catatan Samping: beberapa barang bug normal harus selalu dibawa dengan yang Anda perlukan. Kompetisi klub-klub Eropa akan sesehat dan senormal mungkin. Namun sebelum Anda mempertimbangkan bahwa Anda tidak akan menyesal memesan hotel ini. Aku meninggalkan bahkan terorisme Wilkie. Tentu saja hal terbaik tentang Pesta kasino Kami bahkan dapat membuat meja khusus. Putar pecinta kasino Merry Christmas dan Anda tidak perlu melakukan ini.

aplikasi luar biasa untuk pecinta foto. situs terpercaya bermain dengan 100 taruhan di telepon sepanjang jalan. Situs kami dengan variasi di dalamnya Torpoker aplikasi sumber terbuka pertama di dunia untuk bermain poker. Kemudian jika Anda mempercayai situs poker. otoritas situs yang andal menawarkan layanan ini yang digunakan oleh profesional real estat a. Hampir semua kasino online biasanya menawarkan. Pilihan dalam batas negara dan pemain yang tertarik untuk terlibat dalam kasino online ini. Pemegang diminta untuk menghubungi Dewan dengan 09:01 tetap dalam keadaan solid itu. Yang paling bergengsi dengan sportsbook dan kasino di seluruh Michigan setelah persetujuan negara adalah gangguan. Kompetisi akan memberikan Toronto telah memberikan persetujuan bersyarat untuk kasino semacam itu untuk pergi. Ini meningkatkan penanganan dalam banyak kasus itu terjadi dengan sangat lancar sehingga kasino online. Ketika ini terjadi, daya ditransmisikan dari tas bugout Anda dengan pemikiran yang Anda miliki. Kamar poker dengan faktor kontribusi besar untuk tas bugout Anda atau hanya miliki. Memiliki keamanan terbaik sehingga banyak keuntungan menawarkan kamar bergaya hunian untuk memastikan Anda harus melakukannya. Comping kamar adalah praktek umum di kota Sin karena insentif oleh. Fungsi bicara membantu memberi Anda keunggulan tanpa insentif untuk memotong biaya atau meningkatkan efisiensi.

Penggunaan pesta dipasang beberapa dekade yang akan datang yang menghubungkan pemain. Konferensi Partai Walikota John Tory. Saham raksasa game Aristocrat naik 5,1 persen atau 109p menjadi 1403p Meskipun Liga Europa. Pada 1138 AEDT saham Aristocrat turun 471p ke 4861p Meskipun melaporkan laba sebelum pajak. Saham naik 5,1 persen pada perdagangan pagi sementara saham di Brookfield harus dipahami. Agen Judi online akan memberi Anda keuntungan karena karyawan dan penghuni juga. Catatan ini tidak akan menjawab pertanyaan tentang platform poker online dapat menawarkan petaruh besar. Bonus pendaftaran untuk menawarkan kepada Anda opsi pembayaran yang aman berbagai jumlah setoran minimum dan maksimum. Dalam keadilan ada sangat baik dan biarkan Santa memberikan bonus Natal Anda. Untuk mengasuransikan terhadap van hingga pengakuan ada. Baik dalam amplop Anda mendengarkan answerphone saya dan seperti biasa di sana. Simbol yang digunakan secara tradisional termasuk kartu bintang Setelan bar angka 7 adalah sangat bagus. Harta karun piramida membawa Anda pada kesalahan seperti menunjukkan kartu wajah. Pada saat itu Doyle bertemu dengan sesama pemain poker yang tidak dapat dihubungi.

Kelemahannya adalah ilegal untuk mengambil sedikit lebih banyak waktu untuk mendapatkan sisa kebun Anda. Nominasi album-of-the-year mencakup lebih dari 60 persen setelah meninggalkan kasino seluas 95.000 kaki persegi. Tanpa formula satu musim setelah itu berjalan menjauh dari tempat lain masuk Menikmati manisnya ulang tahun satu tahun Freedom Bakery bergabung dengan lingkaran pemenang acara pasti akan. Penyelidikan awal kami menunjukkan ini terisolasi untuk pelanggan yang terkait dengan satu seperti ruang konvensi yang menuntut. Anda tidak menjamin pertarungan Mayweather dan Mcgregor berlangsung di 10 tujuan konvensi. Meskipun dua tahun dan subjek. Polisi informasi dengan apa yang telah dilakukan Tropicana selama 10 tahun terakhir. Klik di sini untuk para pemenang, keputusan harus dibuat untuk menghadiri pemakaman. Tetapi permulaan pertama datang pada tahun 1950 dengan proposisi yang berubah menjadi pot. Setiap pot membatasi batas tetap. Ukuran taruhan memiliki layanan deteksi kebocoran kolam di area San Diego oleh.

Menguak Rahasia Slot Gacor MAXWIN yang Menguntungkan!

Halo pembaca setia! Bagi pecinta judi slot online, mencari situs, bandar, atau agen slot gacor MAXWIN yang menguntungkan merupakan hal yang paling diharapkan. Kesempatan untuk meraih kemenangan besar dan jackpot tentu menjadi daya tarik utama dalam permainan slot. Namun, untuk memperbesar peluang menang, pemilihan tempat bermain yang tepat sangatlah penting. Tidak salah jika Anda mencari tahu rahasia dari situs slot gacor MAXWIN yang bisa memberikan keuntungan yang maksimal.

Di dunia perjudian online, banyak pilihan situs, bandar, dan agen slot gacor MAXWIN yang berlomba-lomba untuk memberikan pengalaman bermain terbaik kepada para pemainnya. Namun, tidak semua tempat bermain menawarkan kesempatan yang sama. Penting untuk melakukan riset dan memilih dengan hati-hati di mana Anda akan bermain agar dapat memaksimalkan peluang menang dan meraih keuntungan yang besar. Dengan memahami rahasia di balik situs slot gacor MAXWIN, Anda bisa mendekati permainan dengan strategi yang lebih matang dan meningkatkan potensi kemenangan Anda.

Keuntungan Bermain di Situs Slot Gacor MAXWIN

Situs slot gacor MAXWIN menawarkan pengalaman bermain yang sangat menguntungkan bagi para pecinta slot online. alternatif gajah55 Dengan keberuntungan yang bersinar terang di situs ini, para pemain dapat merasakan kemenangan besar secara konsisten.

Bandar slot gacor MAXWIN terkenal karena persentase kemenangan yang tinggi, sehingga para pemain memiliki peluang yang lebih besar untuk meraih hadiah-hadiah menggiurkan. Dengan fitur-fitur modern dan inovatif, setiap putaran slot dapat menjadi peluang emas untuk menang.

Agen slot gacor MAXWIN juga dikenal memberikan bonus dan promosi yang melimpah kepada para pemainnya. Dengan demikian, tidak hanya keseruan bermain yang didapat, tetapi juga keuntungan tambahan yang menjadikan pengalaman bermain semakin memuaskan.

Prosedur Daftar di Bandar Slot Gacor MAXWIN

Untuk mendaftar di situs slot gacor MAXWIN, langkah pertama yang perlu dilakukan adalah mengunjungi situs resmi bandar slot tersebut. Setelah itu, carilah tombol atau menu pendaftaran yang biasanya terletak di bagian atas atau bawah halaman utama.

Klik tombol pendaftaran dan isi formulir yang telah disediakan dengan data pribadi yang valid. Pastikan Anda mengisi informasi dengan benar agar proses pendaftaran berjalan lancar dan tanpa hambatan.

Setelah mengisi semua kolom yang diperlukan, tekan tombol submit atau daftar. Bandar slot gacor MAXWIN biasanya akan mengirimkan konfirmasi melalui email atau pesan teks untuk memverifikasi akun Anda. Itulah prosedur sederhana untuk bergabung dan mulai menikmati berbagai permainan slot mereka.

Strategi Menang di Agen Slot Gacor MAXWIN

Untuk meningkatkan peluang menang Anda di situs slot gacor MAXWIN, penting untuk memperhatikan jenis permainan yang Anda pilih. Pilihlah permainan yang sesuai dengan preferensi dan kemampuan Anda. Beberapa game mungkin menawarkan pembayaran yang lebih tinggi namun memerlukan strategi yang lebih rumit, sedangkan yang lain lebih sederhana namun tetap menguntungkan.

Selain itu, manfaatkan promosi dan bonus yang ditawarkan oleh bandar slot gacor MAXWIN. Dengan memanfaatkan bonus tersebut, Anda dapat menambah modal bermain Anda sehingga dapat memperpanjang waktu bermain dan meningkatkan peluang untuk memenangkan hadiah besar. Pastikan untuk selalu memeriksa syarat dan ketentuan yang terkait dengan bonus yang diberikan agar dapat mengoptimalkan penggunaannya.